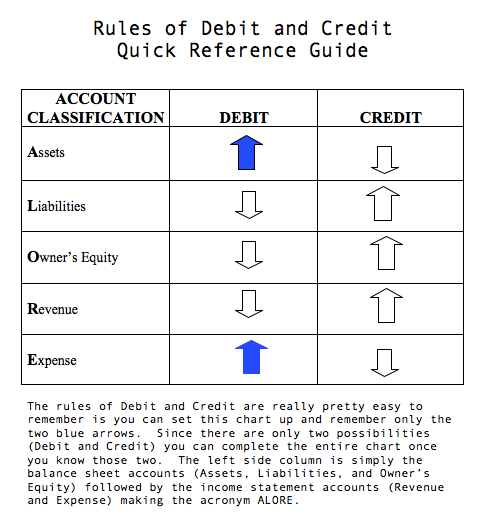

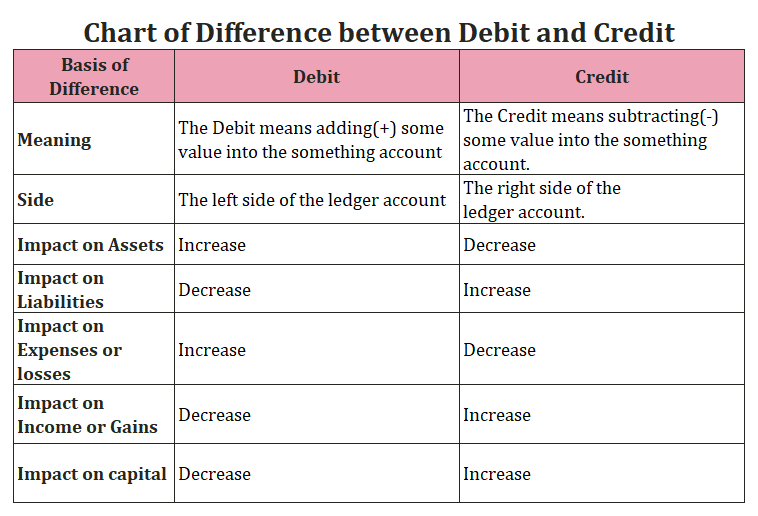

Hence, the accounts such as Rent Expense, Advertising Expense, etc. To reduce the normal credit balance in stockholders' equity accounts, a debit will be needed. Therefore expense accounts will have their balances on the left side. If this transaction were entered in a general journal, it would appear as follows:Įxpenses decrease stockholders' equity (which is on the right side of the accounting equation). At the end of the accounting year, the balances in all of the income statement accounts will be closed/transferred to Retained Earnings.) (In other words, we temporarily credit Service Revenues instead of crediting the stockholders' equity account Retained Earnings. The reason is that we want the amount of revenues to be reported on the current period's income statement. Note: Even though stockholders' equity will increase, the transaction is recorded in the account Service Revenues. Here is what occurs in the general ledger accounts: Here's the effect on the accounting equation and the company's balance sheet as a result of earning the revenues: This increases the company's asset account Accounts Receivable. The company earns the right to receive $400.Revenues of $400 are earned and that causes stockholders' equity to increase.To illustrate, let's assume that a company provides a service and bills the customer $400 with the amount due in 30 days. Therefore the balances in the revenue accounts will be on the right side. Revenues increase stockholders' equity (which is on the right side of the accounting equation). If this transaction is entered in a general journal, it would appear as follows: Here is what will occur in the general ledger accounts: Here's how the transaction will impact the accounting equation and the company's balance sheet: The amount received for the shares will be recorded as part of the corporation's stockholders' equity. The corporation issues shares of common stock.The corporation receives cash, which is recorded as a corporation asset.There are two effects of this transaction: To demonstrate the debits and credits of double-entry with a transaction, let's assume that a new corporation is formed and the stockholders invest $100,000 in exchange for shares of common stock. This means that stockholders' equity accounts such as Common Stock, Retained Earnings, and M J Smith, Capital should have credit balances. In the accounting equation you can see that stockholders' equity is on the right side of the equation:Īgain, credit means right side and our T-account showed credits on the right side. Stockholders' equity account balances should be on the right side of the accounts. Stockholders' equity is on the right side of the accounting equation. Thus liability accounts such as Accounts Payable, Notes Payable, Wages Payable, and Interest Payable should have credit balances. Recall our T-account that showed credits on the right side: In the accounting equation you can see that liabilities are on the right side of the equation:Įarlier you learned that credit means right side. Liability account balances should be on the right side of the accounts.

Liabilities are on the right side of the accounting equation. Hence, asset accounts such as Cash, Accounts Receivable, Inventory, and Equipment should have debit balances. Recall our T-account that showed debits on the left side: In the accounting equation you can see that assets are on the left side of the equation:Įarlier you learned that debit means left side. We will use the accounting equation to explain why we sometimes debit an account and at other times we credit an account.Īssets are on the left side of the accounting equation.Īsset account balances should be on the left side of the accounts. Hence the balance sheet must also be in balance. The accounting equation is also the framework of the balance sheet, one of the main financial statements.

#Debit credit chart accounting plus

In other words, not only will debits be equal to credits, but the amount of assets will be equal to the amount of liabilities plus the amount of owner's equity. With double-entry accounting, the accounting equation should always be in balance. The basic accounting equation is:Īssets = Liabilities + Stockholders' equity (if a corporation)Īssets = Liabilities + Owner's equity (if a sole proprietorship) It can also provide insights into debits and credits. The accounting equation is a central part of bookkeeping and accounting. We will also provide links to our visual tutorial, quiz, puzzles, etc. If you are not familiar with debits and credits or if you want a better understanding, we will provide a few insights to help you. If you already understand debits and credits, the following table summarizes how debits and credits are used in the accounts. Statement of Stockholders' Equity, Closing Cut-Off, Importance of Controls

0 kommentar(er)

0 kommentar(er)